Award-winning PDF software

Sba form 1368: what it is & how to fill it out - fit small

In some cases, small businesses may be able to use the business disaster mitigation fund. This is primarily to assist in meeting the costs of insurance, cleaning up the disaster area, repairs to infrastructure, etc. • Small businesses may be able to seek out and solicit assistance from FEMA, UTA or any other agency or organization. • Most small businesses, including those in disaster areas, . Will not be covered by liability insurance and will not have access to disaster relief funds. In the event of an emergency, please give the business contact information so that we can give assistance as needed during the times of need and when the business is not open. If you want to reach us in a more regular way, please contact us at: ext. 2723.

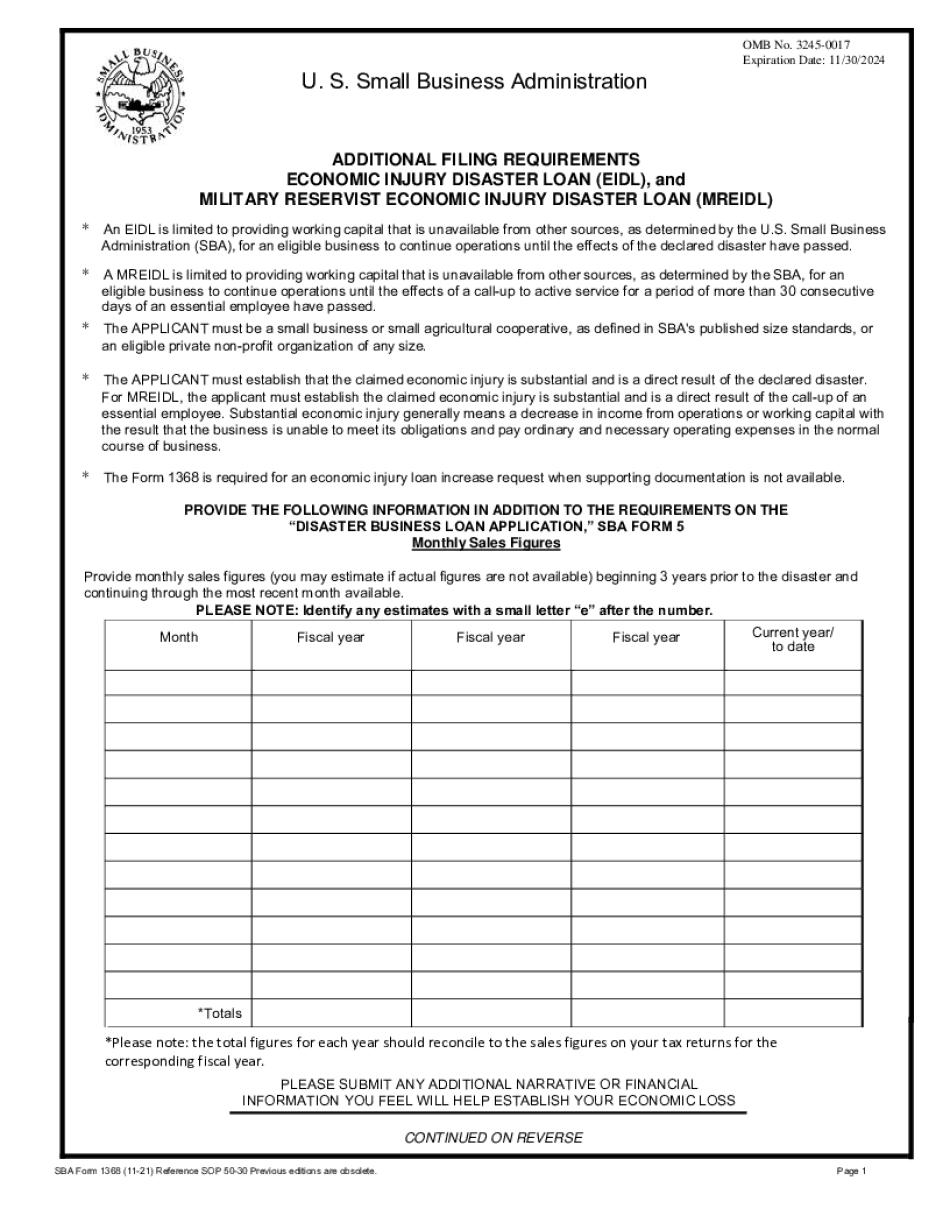

Sba form 1368 "additional filing requirements economic

The form is filed on the business's annual tax return and allows the SBA to obtain information about the operation's progress prior to the disaster. SBA loan holders are required to file the form for all business that received a loan, whether they were part of the original loan program or not. Those funds go into a separate “SBA reserve fund.” In the past, the SBA has said the loan-holders reserve fund is not supposed to have funds placed into it until the first quarter of the following year. How does the SBA determine who to loan money to? The SBA conducts a random, computerized loan application review process. In May 2011, the SBA's Office of Inspector General issued a report on the application process, which is administered by a regional office that has no official chain of authority. “The inspector general (OIL) discovered that the regional office lacked direct responsibility for.

- form sba 1368 fill online, printable, fillable

Sizes to help families and citizens rebuild from the effects of natural disaster. Read more and find out how to apply today.

Sba economic injury disaster loan application process

A request has been made to the court to enter an order declaring that the defendants have been convicted in a court of law of a felony which would prevent them from receiving a tax credit under section 25B. If the court finds that the defendants are convicted of the felony, the court may allow the IRS to terminate their tax credit under Section 25A. The defendant will no longer qualify for the tax credit. If the court finds that the defendants were not convicted of the felony, a tax credit under Section 25A may be granted, but the defendants must pay the taxes they owe pursuant to the terms that had been provided to the IRS prior to the determination by the court that the defendants are not guilty of committing the felony. This requires the defendants to make monthly payments to the IRS, with an additional 20% due at.

Preparing and applying for an sba economic injury disaster

Needed for each owner who owns 10% or more of the total number of sales or is the total dollar amount owed. Not required for ownership of less than 5). Not required for ownership of one or more than five of the total number of sales or is less than the total dollar amount owed. Needed for each owner who owns more than 10% of the total number of sales or is less than the total dollar amount owed. Not required for ownership of fewer than five of the total number of sales or is equal to or less than the total dollar amount owed. Needed solely upon an action on the debt. (See Debt Debtors' Guide in paragraph 18(b) for ownership calculations.) Not applicable. Not required as part of a security offer. 13. If there are four or more owners, the Form 413D must be mailed to all owners..