SBA's primary program, the 7a loan program, helps finance startups and existing small businesses. This program is designed for situations when businesses cannot secure financing from other sources or from lenders who require an SBA guarantee. The 7a loan program is the SBA's most basic and popular loan program, offering flexibility, longer terms, and potentially lower down payments compared to other financing options. It is important to note that these loans are not directly funded by the SBA. Instead, banks receive a guarantee that the SBA will pay a portion of the loan if the business defaults on its payments. This arrangement allows small businesses to obtain loan amounts to fund startup costs, purchase equipment and inventory, and meet working capital needs. The loans made through this program can be used for various purposes. They can be used to start a new business, acquire, expand, export, or continue operating a current business. Specifically, the funds can be used to purchase new land or equipment, including construction costs or repairing existing capital. Additionally, the loans can be used to purchase an existing business, refinance existing debt, or invest in equipment, machinery, furniture, fixtures, supplies, or materials. They can also fulfill short and long-term working capital needs. Apart from providing financial support, the 7a loan program also aims to help small businesses in traditionally underserved markets. It serves as a catalyst for growth and job creation in these areas. The SBA is dedicated to expanding small business access to capital in underserved communities. Initiatives have been developed to offer a more efficient application process for minority-owned, women-owned, veteran-owned businesses, as well as companies located in lower income or rural areas. To be eligible for the SBA 7a loan program, businesses must operate for profit and have reasonable owner equity to invest. They must also conduct or...

Award-winning PDF software

Sba articles Form: What You Should Know

Small Business Administration SBA Small Business Financing Opportunities The Small Business Administration provides funding for small businesses, ensuring that they can buy the assets needed to grow and expand. Small Business Administration You may be able to get business loans from the Small Business Administration by submitting an online application. U.S. Small Business Administration You may be able to get business loans from the Small Business Administration by submitting an online application. The SBA provides funding for small businesses, ensuring that they can buy the assets needed to grow and expand. U.S. Small Business Administration You may be able to get business loans from the Small Business Administration by submitting an online application. The SBA helps U.S. farmers get the credit they deserve; helps protect small businesses from unsafe practices; and supports programs aimed at strengthening farmers' access to capital, providing the latest information about farming and food safety, and promoting rural economic development. The SBA has a nationwide footprint in all 50 states and in all 50 U.S. congressional districts. “Your business needs a safe foundation to grow. The Small Business Administration promotes access to capital and helps small businesses get credit to grow. We work with lenders and borrowers, and with the government and the Small Business Administration to make sure the government, small businesses, lenders and entrepreneurs all are protected.” The Small Business Administration Read more about the SBA's programs. Read about the SBA's financing options and fees. Read about government programs that help small businesses. The SBA assists small businesses with credit, research and development, and training programs to meet their needs for credit and capital. U.S. Small Business Administration Small Business Administration The SBA provides funding for small businesses, ensuring that they can buy the assets needed to grow and expand. Read more about the SBA's funding options and fees. Read about government programs that help small businesses. Read about the SBA's financing options and fees. “The U.S. Small Business Administration works to help American small businesses build a stable and strong financial foundation, so they can build their businesses and grow. The federal programs that the SBA offers enable small businesses to get access to the best financing options, including loans that are guaranteed or that offer the best interest rates and flexible repayment terms. With an SBA loan, you benefit from the protections and services that the federal government provides to small businesses.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

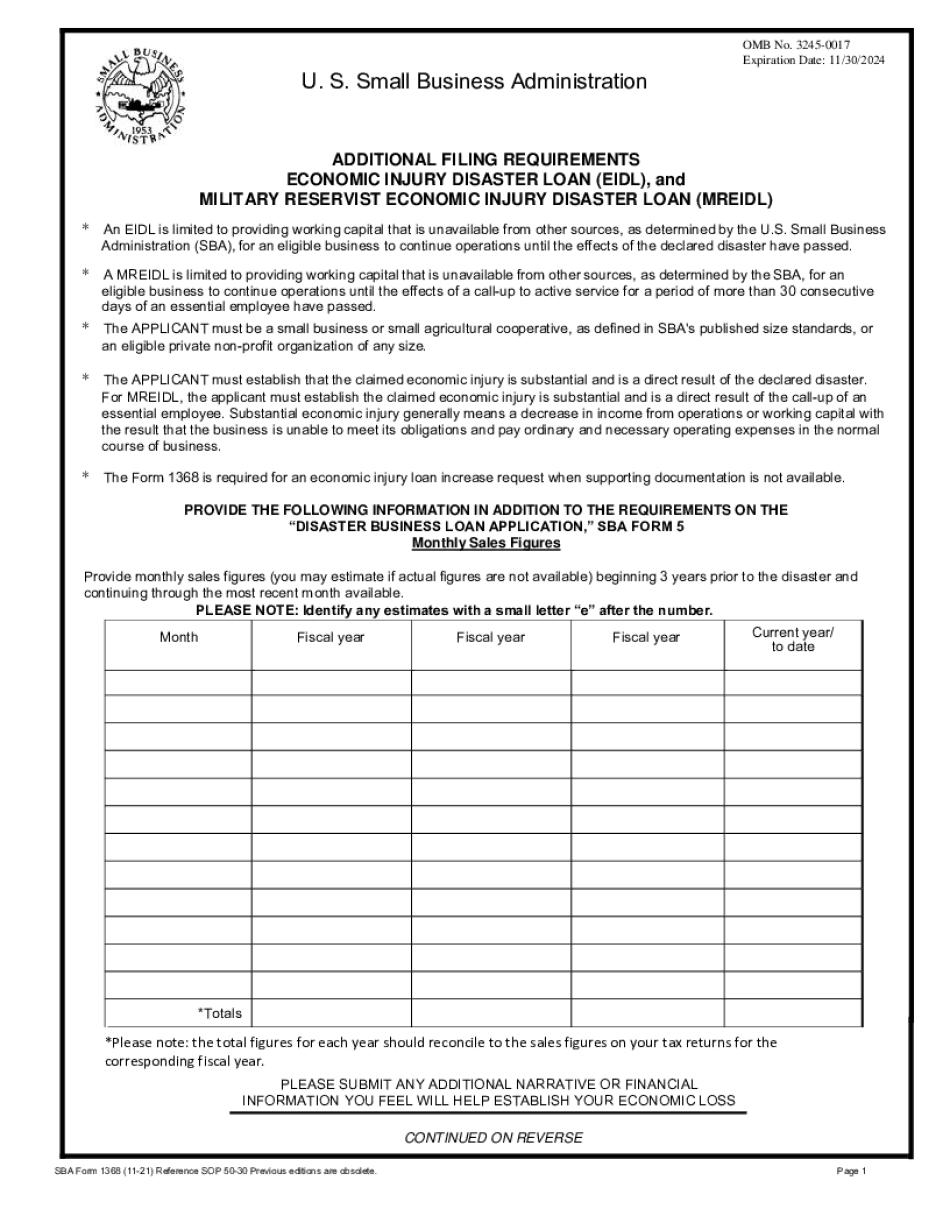

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba articles