Hi, I am Taylor Moffett, of Holley Bean with Kelso US. This video is about how you can get an SBA loan, and not just any SBA loan, but the best SBA loan. In order to qualify, there are a couple of things you need. Firstly, you must have some real estate associated with it. The real estate is what secures your SBA loan. You cannot do an SBA loan if you are just renting a property or working out of your home. It must be a commercial property to qualify for an SBA loan. Secondly, you need to have some down payment money. You must have 30 percent, but if the seller of the business you're buying is willing to carry back ten, you might be able to get away with 20 percent. However, you still need a minimum of 20 percent to secure any type of SBA loan. SBA loans can go up to two million dollars, but it is recommended to look at a minimum of a couple hundred thousand dollars for an SBA loan. Additionally, a personal guarantee is required for your SBA loan. You need to have a reasonable amount of fair credit, as you cannot have horrible credit due to bankruptcy. You must have something decent to show the bank. Furthermore, the business itself must be profitable. You cannot have a failing business that is losing money everywhere and expect an SBA loan to bail you out. Income should be coming into the business, even though you might not be able to service everything. In such cases, you may be able to explore tourniquet financing, but it is not highly recommended. If you want to pursue an SBA loan, there are two main types: the 7a and the 504 SB. It is advisable to choose...

Award-winning PDF software

Sba schedule of business debt Form: What You Should Know

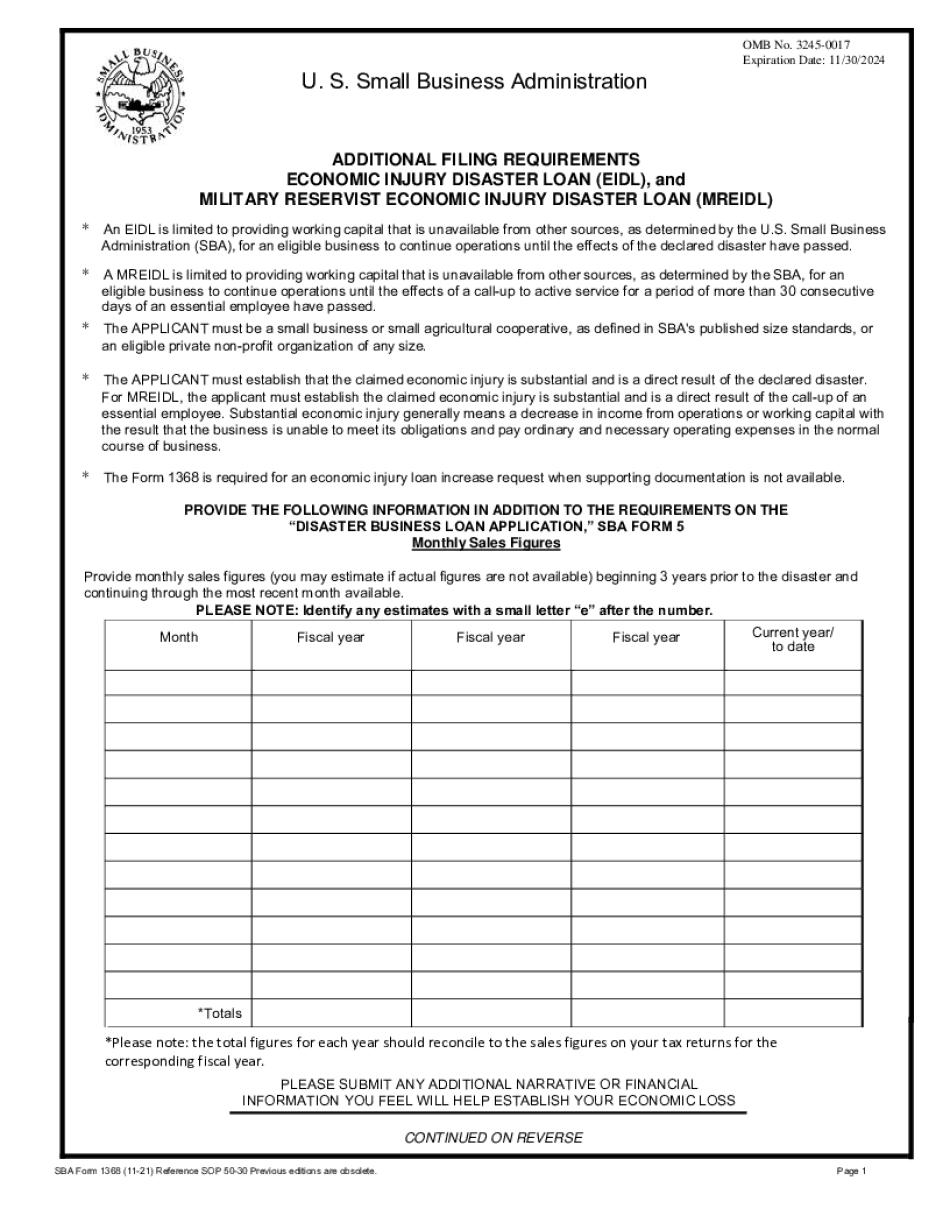

SBA Form 5 This information should be included for the purpose of completing a Disaster Loan program with the SBA.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba schedule of business debt form