Thank you, and thank you, thanks a lot for tuning in once again. My name is Charles with Barthelemy Enterprises Commercial Funding Source. There are two things that we're going to be touching on today. Let me just backtrack real quick. Last week, we touched on the SBA New Art Program that they just released for $35,000. So, what we're going to do is cover today the actual forms that one needs to fill out and complete to get approved for that program and try to get some funding in place regarding that $35,000. The second thing we're going to touch on is the smaller banks versus the larger banks. Which bank should you, as a consumer and as a small business owner, target when it comes to applying for a loan, whether it's an SBA loan or a commercial loan? Without further ado, let's go ahead and jump right into these forms. In regards to the art program, the forms are very simple to fill out, so we won't spend too much time on them. I'm going to go through each form thoroughly so that you understand that it's not a long, drawn-out process. The first form that you're going to fill out is a basic application. It will include your name, phone number, and so on. It'll probably take you around three minutes to fill out. This form comes from the financial institution for their records. The second form that you'll be completing is called the Lender's Supplemental Information for American Recovery ARC Loan Guarantee Request Form. This form is approximately two pages long. In this form, you fill out your name, your company's name, the company's information, address, and whether it's a new or existing business. You also provide information about how long you've been in business...

Award-winning PDF software

Sba s Form: What You Should Know

S. Department of Justice, and by completing the application provided. I also understand, acknowledge, and agree that the United States is not liable for any payment or liability to third parties that has not been collected from the SBA through the loan and no payments have been made to SBA for the loans and, if any payments have been made in accordance with the written agreement in effect by the SBA and Lender, the SBA is required by the Federal Tort Claims Act to recover said amounts from the Lender. I further understand, acknowledge, and agree that the SBA and Lender agree to receive and send to each of us a complete set of the documentation for credit and income-related purposes with the loan in the event that the SBA determines that either of us should default upon a PPP loan forgiveness or receive additional income-related benefits with a loan that may cause our indebtedness to increase. Furthermore, I understand the SBA may make any changes, corrections, modifications, and cancellations to this Agreement. Furthermore, I acknowledge that the SBA's and Lender's obligations are limited by the terms and conditions in this Agreement. Furthermore, I certify under penalty of perjury that the information contained in this form is true, complete, and correct to the best of the information contained in it including but not limited to the information on this form. Furthermore, I also certify under penalty of perjury that the information contained in this form is true and correct to the best of my knowledge and that it is in my best interest that the application be completed and filed.

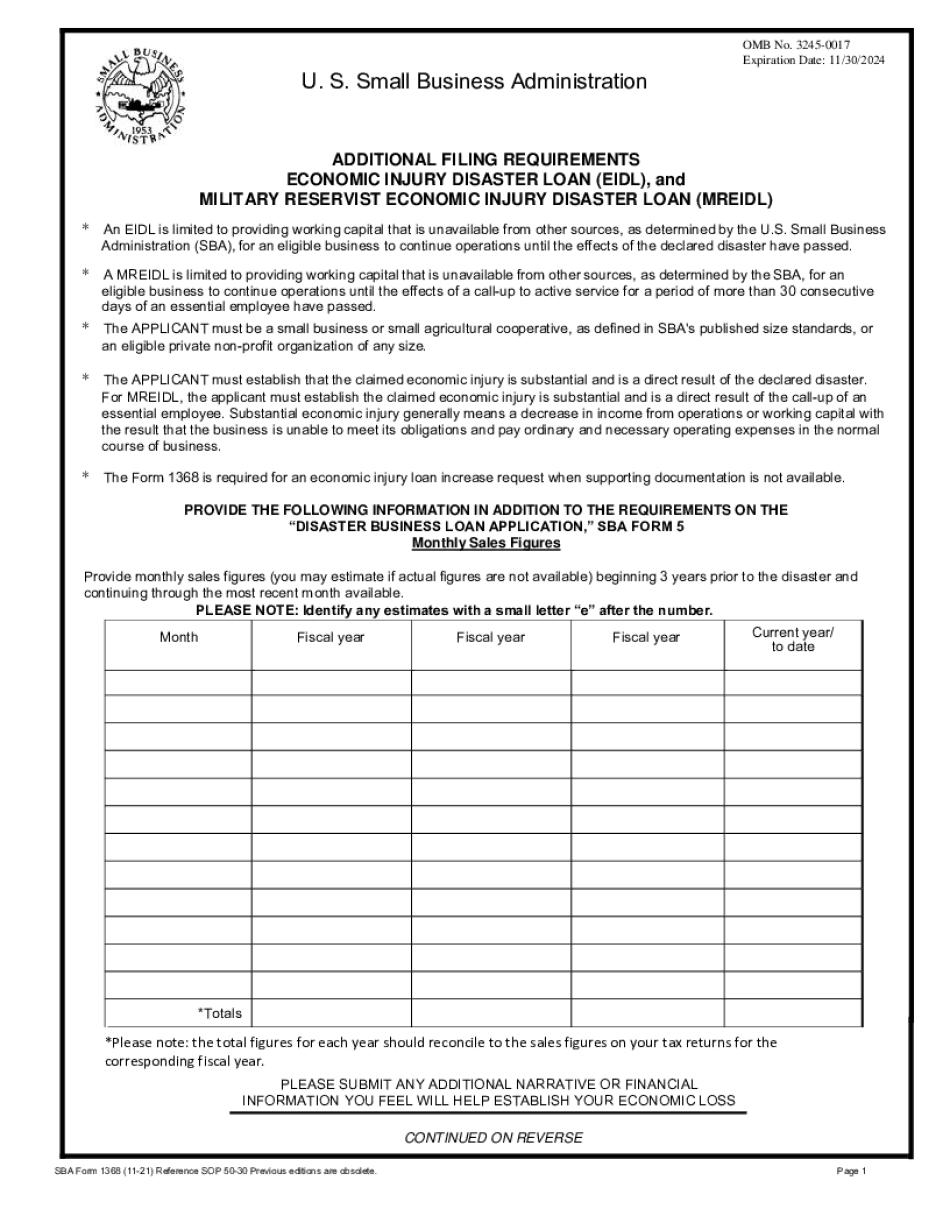

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba forms