This fire caused so much damage. Pennsylvania Governor Ed Rendell is asking for a disaster declaration. The blaze broke out shortly before five Thursday afternoon, snarling rush-hour traffic on Interstate 76 near Philadelphia and halting service on a nearby commuter rail line. Heat from the blaze created an atmospheric disturbance visible on weather radar. It took more than 300 firefighters to battle the eight-alarm blaze. Some were still on the scene putting out hotspots Friday. The couple suffered minor injuries. The fire ruined two buildings and damaged three more at the Riverwalk at Millennium Complex just outside Philadelphia. Almost 400 people lost their homes when 125 apartments were destroyed. Many of them were working with the Red Cross to replace driver's licenses and prescription medication. If the disaster declaration request is approved, the renters and business owners would be able to get low-interest loans to replace lost possessions. Judy Boucher - The Associated Press.

Award-winning PDF software

Sba disaster declarations Form: What You Should Know

There are 2 types of disaster relief grants: one-time grants, and ongoing program, which provides loans for repairs and rehabilitation. This is usually the first point of contact for assistance during any disaster. The SBA office in you area may be able to provide guidance in applying for disaster relief loans. Other Ways You Can Get A Small Business Disaster Loan Disaster Assistance grants are available to eligible non-profit organizations, local communities, individuals, and organizations throughout the United States, Puerto Rico, and SVI. There are four levels of assistance: Level I: Lowest level of the SBA financial disaster assistance program. The SBA provides low-interest loans to non-profit and private non-members with low credit and assets for business interruption or non-disaster needs of a duration less than one year. There is no need to make a down payment for a disaster loan, or to show sufficient assets to absorb the losses. The SBA provides loans in the amounts of 150,000 or less. Level II: Provides up to 500,000 of loans; up to 1,000,000 of loans for disaster related needs with a term of greater than one year. A maximum loan amount of 500,000 may be provided under this tier for both business interruption or disaster related needs. Level III: Provides up to 2,500,000 of loans; up to 5,000,000 of loans for disaster related needs with a term of greater than one year. A maximum loan amount of 5,000,000 may be provided under this tier for both business interruption or disaster related needs. Level IV: Provides up to 10,000,000 of loans; up to 25,000,000 of loans for disaster related needs with a term greater than one year; a maximum loan amount of 25,000,000 may be provided under this tier to offset disaster-related expenses. Disaster loan assistance grants are available to non-profit organizations registered with the SBA. This funding provides a low risk of loss and is available to help eligible SBA-registered non-profit organizations and individuals pay for non-perishable food, gasoline, water, and electricity, repairs to buildings, damages due to natural disasters, repairs to personal or real estate, supplies for funeral and cemetery expenses, transportation support, and business interruption expenses.

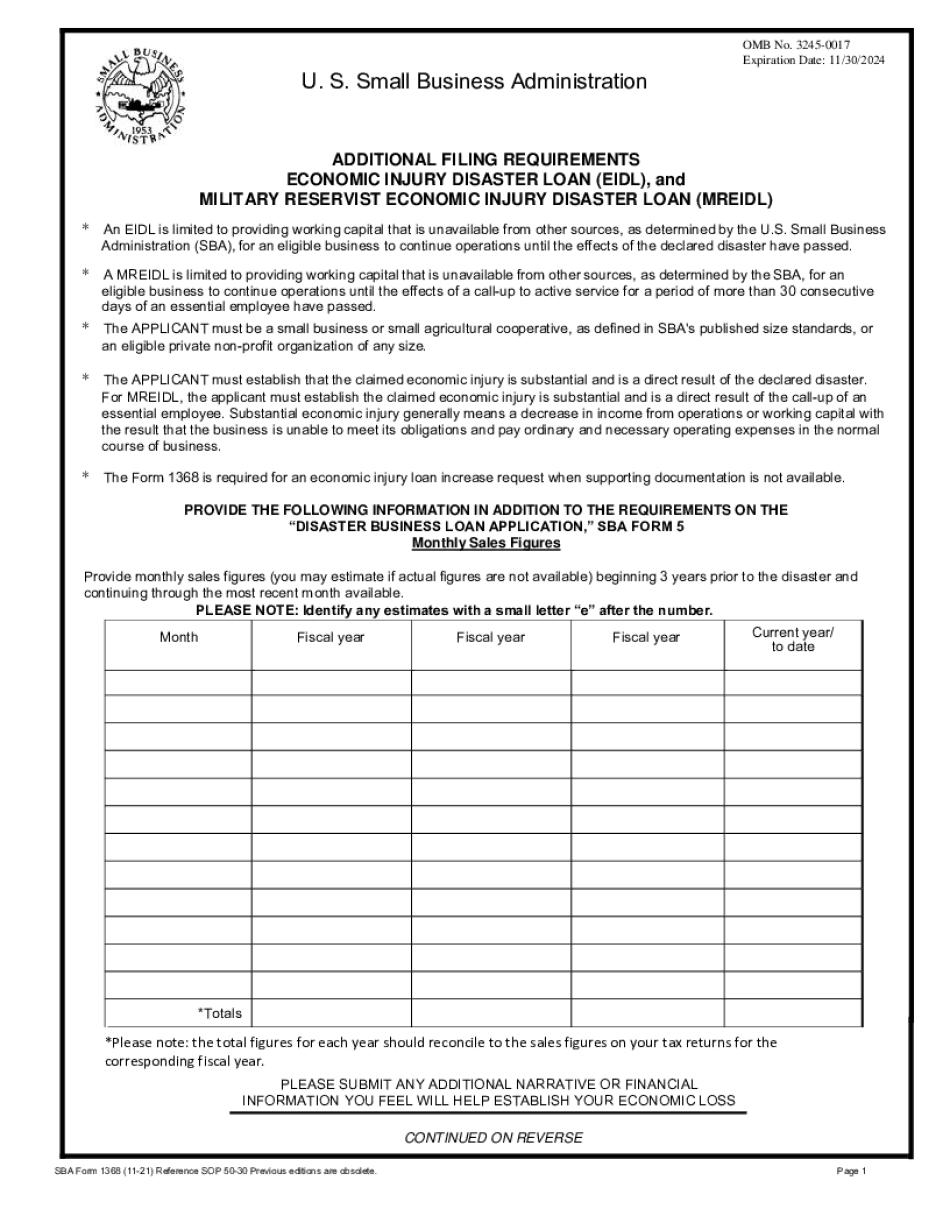

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba disaster declarations