If you're still recovering from April's tornados, there are federal resources available to help families and business owners get back on their feet. - 10news reporter Magdalo Busan joins us live tonight in Lynchburg, where the Small Business Administration has been providing assistance all week. - So Magdala, what kind of help can people get? - John, people can get financial help. I'm here at central Virginia Community College, where SBA has posters similar to the one behind me plastered all over campus and in town. - They want to help people who may still need financial aid apply for low-interest loans. - David Childress is one of the many families from Ellen who lost their homes in April's tornado. - His wife and son were both hurt in the storm but are now doing well, and life is getting back to some sense of normal. - We have rented a house in the Ealing area and we signed a contract this week to start building a new house. - Today, Childress came down to Central Virginia Community College to see what financial help he can get from the Small Business Administration. - We're like a lot of the families in the Ealing area. We have insurance, but unfortunately, the insurance is not going to cover the complete cost to rebuild our homes. - So I wanted to find out how potentially getting a loan here can help cover some of those gaps at no cost. - SBA is in Lynchburg, ready to help disaster victims such as homeowners, renters, and business owners from the Hill City, Amherst, Bedford, and Campbell counties apply for low-interest loans. - We cover things that insurance didn't cover, and even if you haven't settled with your insurance company, you can apply for a low-interest loan. When your insurance pays, you just pay the loan down, and...

Award-winning PDF software

Disaster loans small business administration Form: What You Should Know

The loans are made to businesses and homeowners from FEMA, states, and from nonprofit organizations. The federal government distributes the disaster assistance to support the reconstruction of damaged, blighted, or destroyed property and property of people displaced from their homes during a disaster. You can also use the SBA Disaster Loan Application to: · Apply for a disaster loan; · Apply for a tax credit for qualified disaster expenses; · Apply for a reduction in interest; and · Apply for other disaster expenses, including, but not limited to temporary financial assistance, rental or mortgage assistance, and assistance with health care costs. The SBA Disaster Loan Application is a free federal online service, made available 10 days a week. Use the Emergency Relief section to apply for a disaster loan. The loan application process includes: · Filing and reviewing a complete disaster loan application; and · Downloading and printing a complete, single and detailed disaster loan application. SBA Disaster Loan Application — Emergency Relief There are two categories of disaster relief loans—Low-Interest Disaster Loans and High-Interest Disaster Loans. The Low-Interest Disaster Loan is available for those with a qualifying disaster. The high-interest disaster loan can only be given out to qualified businesses and homeowners. The maximum interest rate on both funds is 6.5%; however, some applicants will be eligible for a lower interest rate for one reason or the other. These funds can only be used within 90 days of application. SBA Disaster Loan Emergency Relief — Low Interest Disaster Assistance The Low-Interest Disaster Relief Emergency Relief is provided as a loan in the amount of up to 5,000 on a 50,000 eligible disaster loan application. There is an additional 5,000 loan limits for these Disaster Relief loans only. There is a 3,000 maximum amounts of loan to which additional amounts of up to 2,500 may be made. The Disaster Relief Emergency Loan is limited for the immediate recovery of uninsured and insurable housing, property damage and loss and personal property loss. The additional 5,000 Emergency Relief loan is available to applicants that incurred any of the following losses: · Lost or damaged personal property; · Lost or damaged real or personal property; · Damaged health or personal property; · Health or personal property damage not due to a natural disaster; or · Health or personal property loss from an act of terrorism, war, terrorism, or insurrection.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

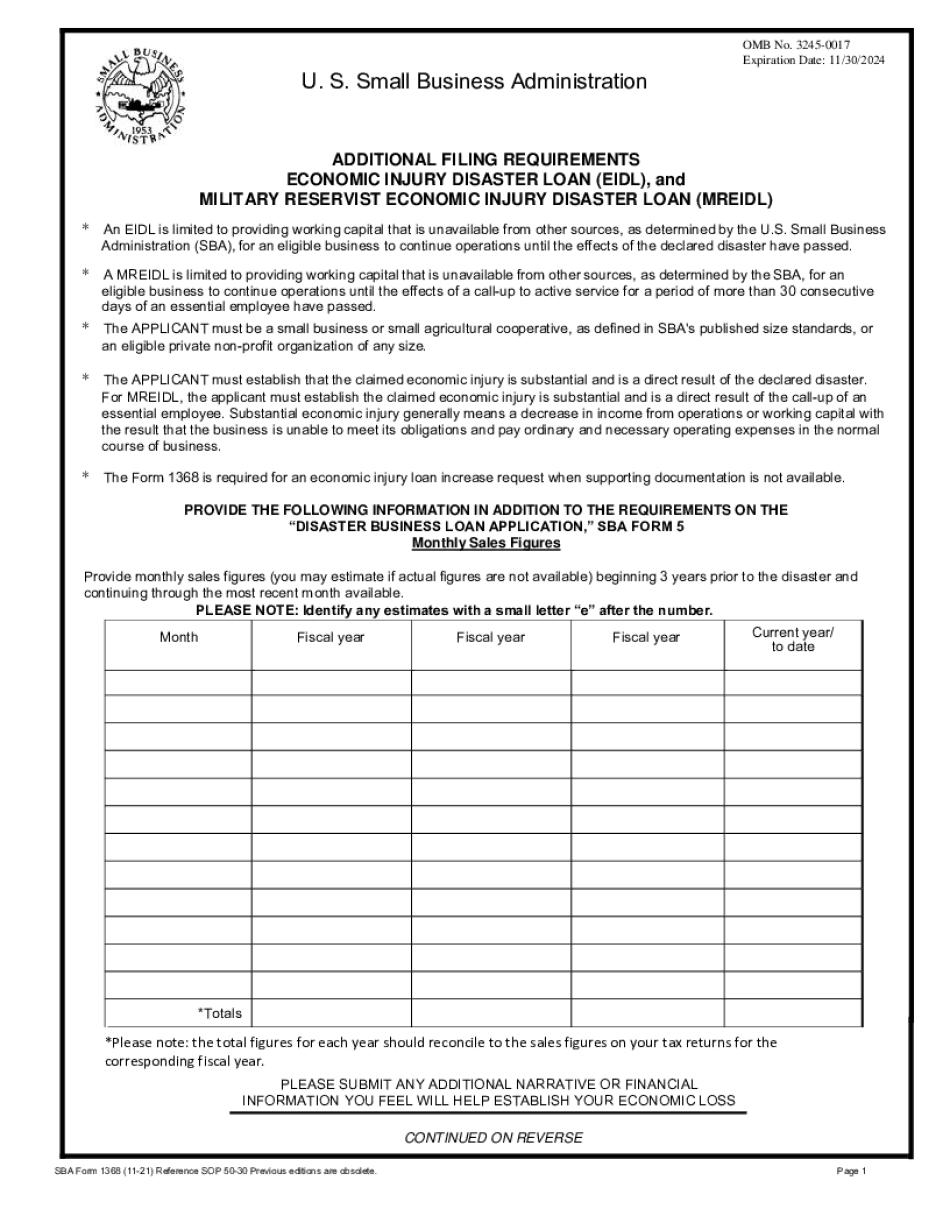

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Disaster loans small business administration