Hey there, everyone! Today, I'm going to show you a debt module I built that is far more complex than your run-of-the-mill debt module. It's for inclusion in your own real estate models. Now, this model, your run-of-the-mill debt module, is modeling senior debt, oftentimes only fully amortized, which is fine but not necessarily representative of the financing environment out there. Oftentimes, you get a package that comes in with existing debt that you're going to have to model the assumption of, and then a refinance of that debt during your whole period. Well, this model includes the ability to do that. Also, oftentimes, you might want to layer on a second or some mez financing on top of your senior debt, and your run-of-the-mill debt module doesn't allow you to do that. This does, so you can change the terms and pricing of your secondary financing so that it's distinct from your senior debt. Finally, this step module allows for some different interest calculation methods, rather than just your standard 3 6 360 over 30. It allows for some different ways of calculating loan amount sizing, the sizing the financing, and some other interesting things. So, I'm gonna run through how to use this and how it's set up, and then feel free to reach out if you have questions. First off, the module is three tabs: a debt tab, which is your inputs tab; an amortization tab, which is your reports tab; and an amortization calc, this is where all the calculations are being done. On the amortization tab, you see each month a rollup of the payments, a combination of your senior debt and your secondary financing, the amount of principal paid in that period, the amount of interest paid in that period, and then the balance of...

Award-winning PDF software

Business debt schedule PDF Form: What You Should Know

Business Debt Schedule Template — Credibly Credit Card Debit Debts Most banks will not accept a debited credit card due to liability. However, you can still use them similarly to unsecured credit cards, so long as you are careful to verify credit history. The following applies to each type of account. Credit Card Debts. The cardholder must pay in full whenever the account is debited. Note that all debts will need to be paid at some point because if the account is under 10,000 it is considered settled and all future payments to the creditor will be made in full automatically. Debt from Line of Credit. Once the line of credit is activated, the account is debited based on the daily balance. Debt from Credit Card. A debit card must be used exclusively to carry out financial transactions related to a financial obligation arising from a trade or business. The account is debited from the debit card, with no other financial obligations such as loans, mortgages, etc. Debit Card Debiting Rules. The maximum daily balance that can be held to pay the debit card is limited to 10,000. Only one debit card can be used for this line of credit, but you can have multiple credit cards on one line of credit. Debit card transactions will be subject to the rules set forth in § 824.2. Debt from Lines of Credit Lines of credit can be applied for up to a maximum of 10,000 for a single account per date under the line. Debit Card Debiting Rules. If the amount you wish to spend is within any line of credit limits, the total amount will be debited from the credit card at the amount set forth in the statement or the maximum daily balance of 10,000. When you use a debit card, the credit card company will deduct payments from your line of credit using the same system as if the debit card had been used on a regular card for purchases. Debit card transactions will be subject to the rules set forth in § 824.1. Debit Card Debiting Limits. In addition to the daily limit of 10,000, certain conditions must be met: The total amount you intend to spend will exceed any 10,000 spending limits. If the total spending is greater than the daily limit, there may be overdrawing fees associated with certain transactions.

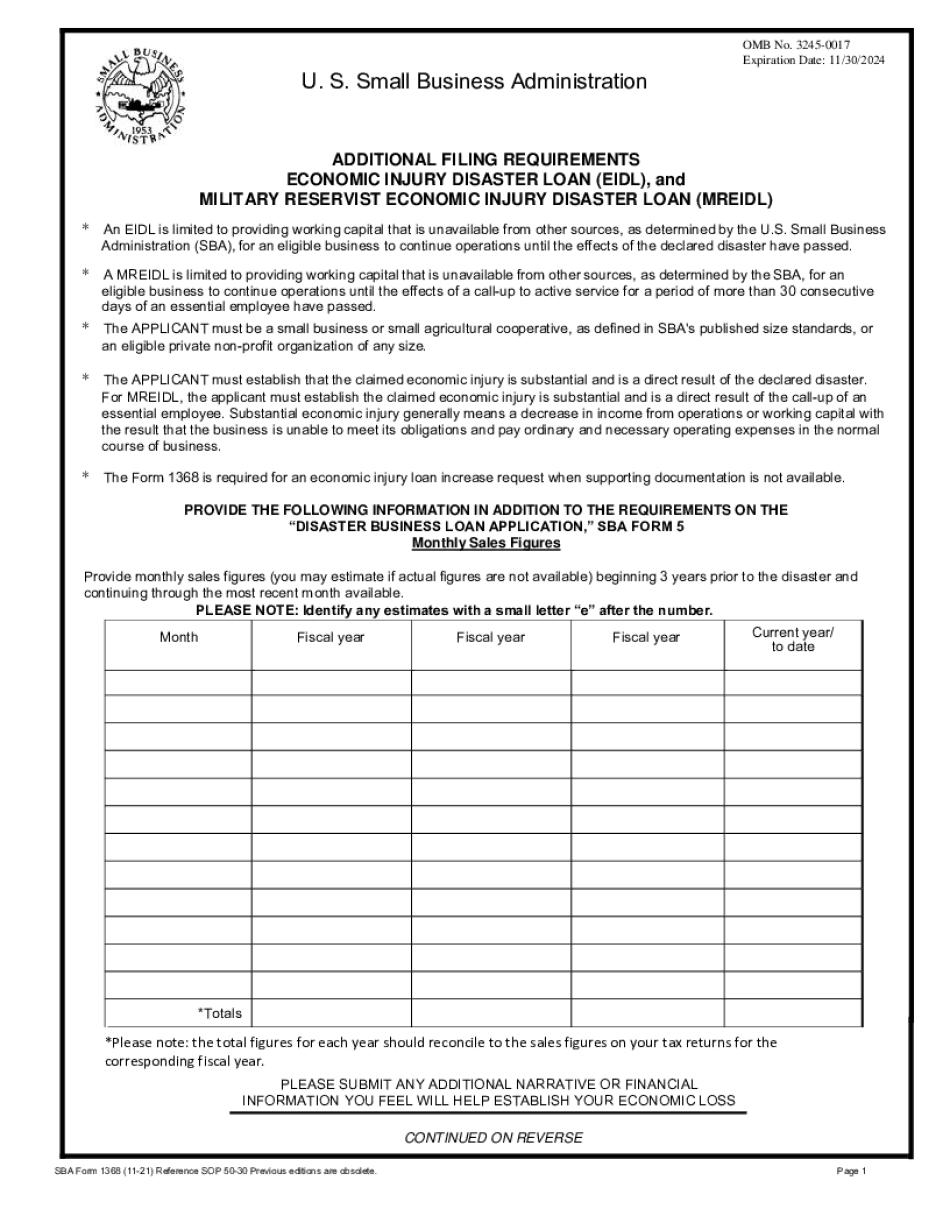

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Business debt schedule PDF