Good afternoon, everyone. This is Aura Gorian with Cap Advisors and Accountants. Thank you for joining us for another webinar series where we talk about very specific subjects, whether it's expanding your business, investments, taxes, and today we have a really special treat. We have Ryan Rock from Mission Valley Bank. He's going to tell us everything we want to know about SBA lending, Small Business Administration lending. Most of you who typically listen to our webinars know me as Aura from Cap Advisors and Accountants, but today I'm actually wearing two hats. Not only am I with Cap Advisors and Accountants, but I'm also on the board of directors of Mission Valley Bank. Mission Valley Bank is a small business lender here in the LA area, and we focus really on high-quality customer service for our clients, primarily business owners. Ryan Rock is one of our main business development lenders, and he's going to talk really in-depth about, as I mentioned, SBA loans. Ryan's got a really great background. Ryan, I'm sure I'm not going to do it justice, but when the time comes, please give us a quick background about yourself and let me just talk about some ground rules for the presentation. But I want to circle back to you, kind of what you're, you know, the different skill sets you bring to the table for your clients. Before we get started, I want to point out that this webinar is being recorded and you can see it and hear it later on our website at here shown a cap am forward slash webinar. If you have questions, please submit them right below where it says Q&A. We promise we're going to get to all the questions at the end and not only that, we're going to...

Award-winning PDF software

Sba 2202 Form: What You Should Know

SBA Form 2202, Schedule of Liabilities — SBALOANFORMS SBA Form 2202, Schedule of Liabilities -- SBA Loan Application | Schedule of Liabilities Form 2202 Instructions | SBA Personal Financial Statement Note: Only use “SBA Note to Owner” as your owner of the business. It is not for the individual who will own the business after the SBA loan is made. Use “SBA Note to Owner” Form 2202 for all your debts. It is your own personal note to that individual who will own the business later on. Note that this only includes the debts that will be created or acquired after the SBA loan is made. Only debts that do not pass due date are on Schedule of Liabilities. It is called a Schedule of Liabilities because all debts of the business must be reflected on it. However, it only shows fixed debts. Other debts can be described by the A statement like: “The balance of the bank account with the last recorded date of activity (e.g., tax year) is 1,812,000 with no outstanding balances as of Jun 10, 2019.” The amount shown on the bank statement must be shown on the Schedule. This is the suggested format. SBA Form 2202, Schedule of Liabilities -- SBA Loan Application | Schedule of Liabilities Form 2202 Instructions This format allows you to list only fixed debts that will result in debt. It is not possible to list all the things the business would be able to pay in terms of debt reduction. SBA Form 2202, Schedule of Liabilities — SBA Loan Application | Schedule of Liabilities Form 2202 Instructions Only list the fixed debts which are included in the loan application. For Fixed Debts Use “SBA Notes to Owner” Form 2202. It is not necessary to list all other debts of the business if the Form 2202 has already been filled out as described above. The amount shown on the bank statement must be shown on the Schedule. It has to be shown on the SBA loan application as shown. If the interest payment is also shown on Schedule of Liabilities, make sure to separate one interest payment from another. Do not put the interest payment in any column other than Fixed Debts. Note that you could still list other debts if they are in terms of the business in a future sale of the business.

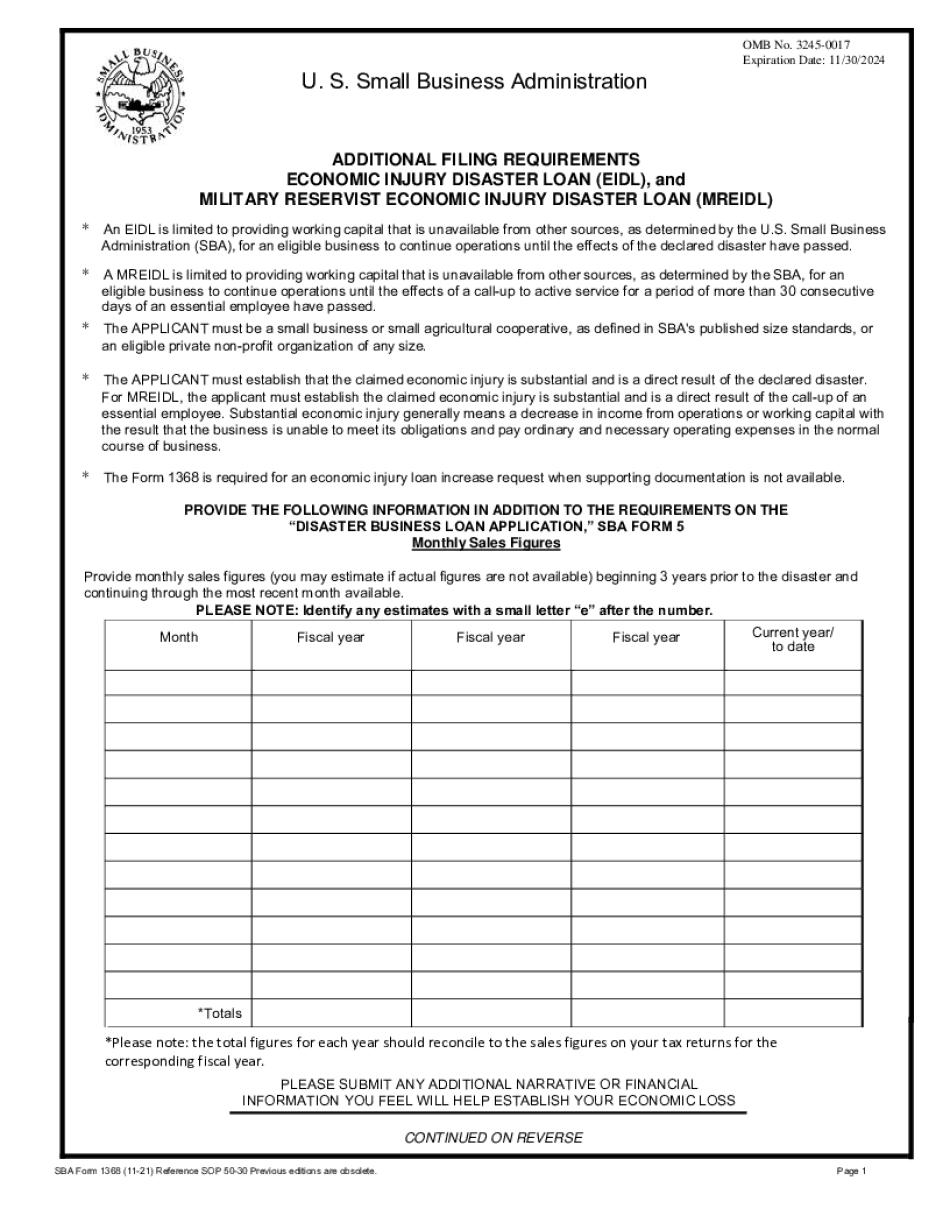

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba 2202