Hey, this is Phil. When we're now on the business debt schedule, this is a form that should be filled out for each one of your businesses. Real quick, this is the overview video. In another video, we'll do step by step. So, okay, as I said, this is for each one of your businesses. Don't combine them, that's a common error that people make. So just put one company. The update should match the profit loss and balance sheet that date, the date of your balance sheet. You're going to give the letter so something current, a month-end date. Make sure you list out all your debts that are to that company, not personal debts, not to other companies, just to this company. As much of this information as possible really helps determining the best avenue of, should we refinance this, or is it good debt that you should keep? Alright, so the name of the creditor is the purpose of the loan, working capital, buying a war or buying real estate, equipment loan, inventory, stuff like that. Lowe's is specifically used for buying out a partner, so put the purpose there. When you got it, how much the original loan was, how much you currently owe on it, your interest rate, your monthly payment, when it matures or you know how long is it five-year term, ten-year term, and what secures it. A lot of debt, such as your credit card, your business credit cards, that will be on here might not have any collateral, so you can write down in here, but if it is secured by equipment or real estate or business assets, put that here. Sometimes you don't know, so you can leave it blank, but do the best to fill it out. Also, mark...

Award-winning PDF software

Sba debt schedule Form: What You Should Know

Follow us on Twitter “Litigator” is a slang title for a lawyer or other legal practitioner; the word comes from a phrase “litigator for hire” meaning someone paid to represent a client in a legal dispute. For instance, a litigator may represent the employer in a lawsuit against the employee or other person involved. Litigators represent a client but will not practice law on their own behalf. In return for the lawyer's assistance a client usually gives the lawyer a percentage of the proceeds of the dispute.

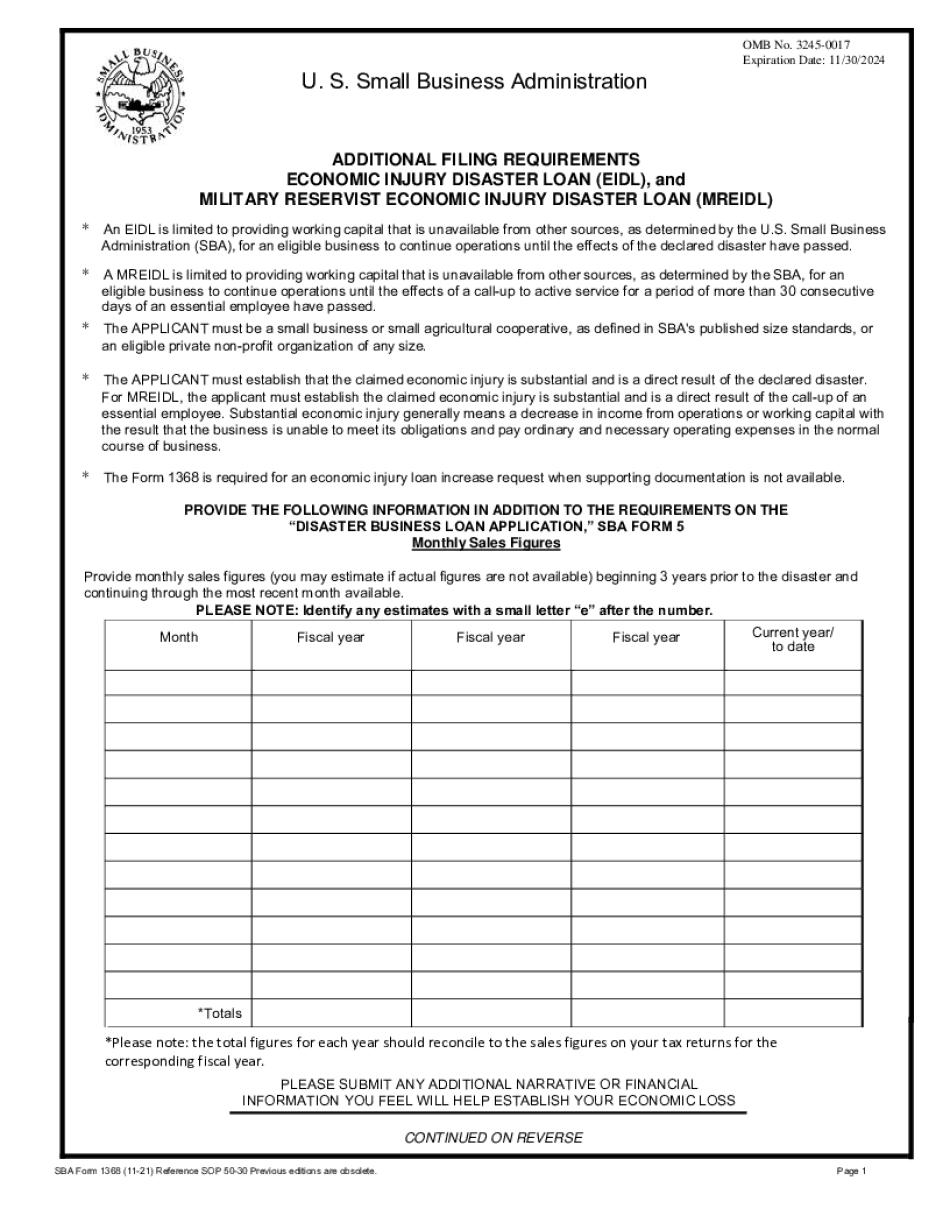

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba debt schedule