Award-winning PDF software

Sba 2202 instructions Form: What You Should Know

Alt + Page Down, Page Up. YouTube · speaker What is a “Force” Profile? YouTube · June 27, 2018, SBA Form 2204/2204A/2204E If the applicant has a credit line greater than 1,000,000, the SB ASB recommends an SBA Form 2204 (or 2204A, 2204E, or 2204T). For other accounts, an SBA Form 2204 must be used. For information relating an SBA Form 2204A, check the form's page on the Website's Help page. YouTube · Nov 3, 2020 Instructions for the SB ASB Web Form2204/2204A/2204E Video How to Fill out the Web Form or to get Help with This SB ASB Form The SB ASB does not have a form to fill out. To get Help with this SB ASB Form, please contact us. SB ASB Web Form2204/2204A/2204E Video Instructions on Use of the Web Form for Small Businesses, the Self-employed, and Other Independent Businesses How to Submit a Payment to SBA 2204 This Web Form allows a credit-eligible individual to submit a check or money order payable to the Small Business Administration (SBA) in an amount and with a type and amount within their means to satisfy a liability on some of the SBA's forms for certain financial assistance programs such as the Disaster Loan Program, the Loan to Buy Back program, or the Small Business Acceleration Loan Program. The Form is available on the SB ASB webpage by following the above links. YouTube • Nov 4, 2019 Instructions for Paying the SB ASB for a Bill of Credit You cannot pay the SBA by using the SB ASB Web Form 2204/2204A/2204E form. You are required by law to submit a check or money order to the SBA. To use this form, you must use the following instructions. YouTube If you live in one of the following states and have a current bill of credit (BC) for the SBA, we strongly suggest you fill in your personal information. Alabama Alaska Kansas Kentucky Maryland Missouri North Carolina Oklahoma South Carolina Tennessee Texas Wyoming If your bill of credit has an interest rate that is over or under 7.

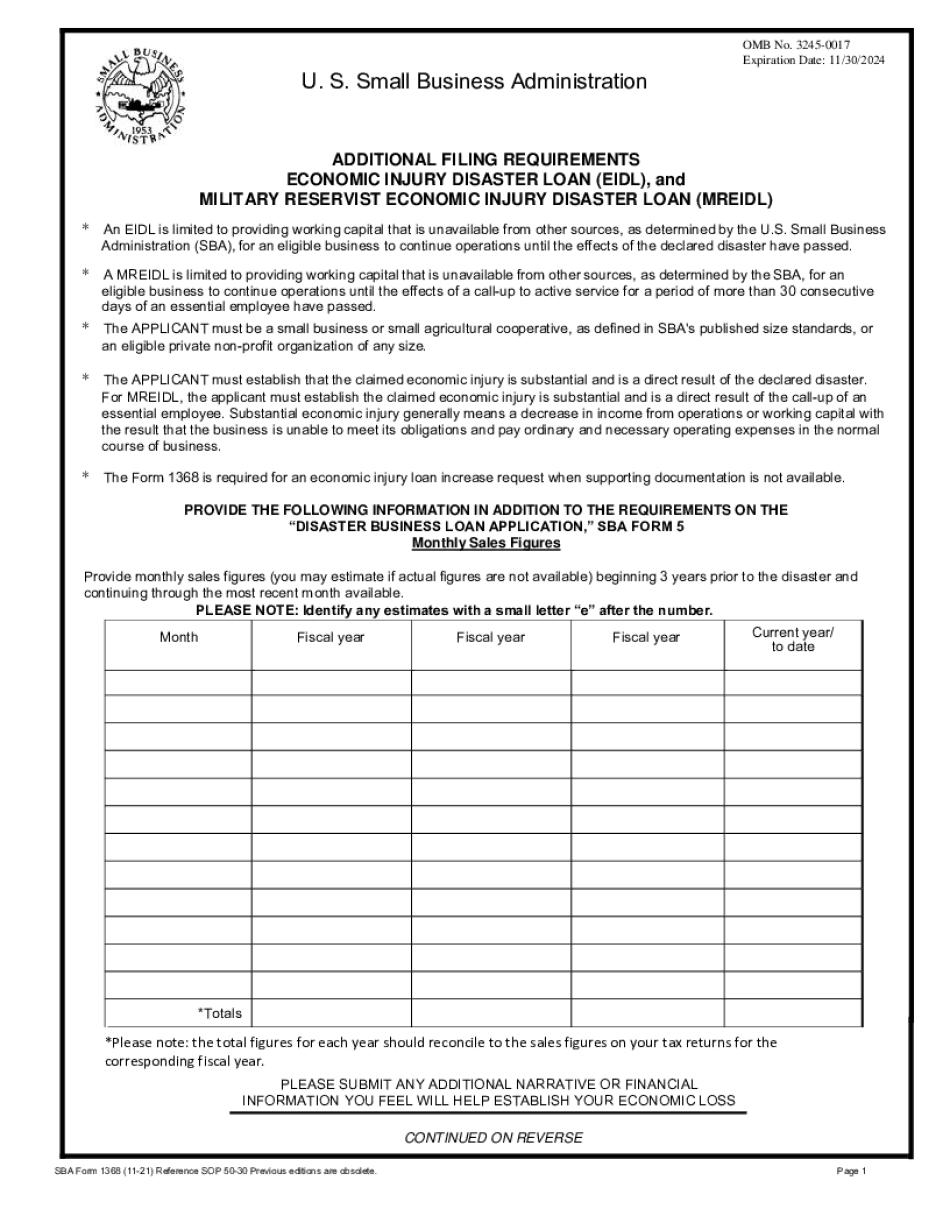

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.