Renters with disaster damage our loss may be eligible for federal help renters who experience losses from federally declared disasters may be eligible to get disaster recovery assistance from the Federal Emergency Management Agency FEMA and the US Small Business Administration SBA survivors may be able to get grants from FEMA to help with such disaster related expenses such as renting a new place to live when their previous home was lost due to the damage disaster related medical and dental expenses replacement or repair of necessary personal property lost or damaged in the disaster such as microwave refrigerator couch bed textbooks computers used by students and work equipment or tools used by self-employed repair or replacement of vehicles damaged by the disaster disaster related funeral and burial expenses Demuth's grants are not loans and do not have to be paid back FEMA grants are not taxable and will not impact the benefits you may receive from Social Security Medicaid welfare assistance supplement nutritional assistance program snap or any other programs you may get benefits from renters who sustained losses can call 861 3 362 video relay users or 7 1 1 users may call 861 3 362 tty users may call FEMA directly at eight hundred four six two seven five eight five or you can go online at disasterassistance.gov use the FEMA app for your smartphone's renters also can register with FEMA at a disaster recovery center to find the nearest disaster recovery center visit w-w-w dec the US Small Business Administration offers low-interest loans to businesses of all sizes most private nonprofit organizations homeowners and renters renters may be able to get SBA low-interest disaster loans for up to forty thousand to help repair or replace disaster damaged personal property for more information about disaster loans call...

Award-winning PDF software

Https disasterLoan Sba gov ela account register1 Form: What You Should Know

Disaster loans — You can obtain a Disaster Loan from the SBA in order to make short- and long-term needs meet during one of the following disasters: fire, lightning, severe weather or a general disaster. The SBA does not make direct funding grants or loans. The SBA also does not offer loans to non-profit organizations for disaster assistance. FEMA Disaster Loan Program The Federal Emergency Management Agency, known as FEMA, may reimburse qualified low-interest loans made to individuals, organizations, state or local governments or private foundations for disaster relief. To obtain assistance, visit the FEMA website for local, state, and Federal disaster assistance and to search for resources in your area that are offering disaster assistance. For more information, please visit our Helping Families & Communities site. Disaster Loan Program The Federal Emergency Management Agency, known as FEMA, may reimburse qualified low-interest loans made to consumers, organizations or businesses for disaster relief. To receive assistance, you must: • Be current on mortgage or homeowners' insurance payments and be able to demonstrate financial need • Rent the property you have the assistance loan for and not have any current liability or expenses • Purchase a property that you want to rent out to a tenant and also to a third-party tenant when needed • Own or have the ability to use real estate that qualifies to be owned or rented by a private individual or a legal entity, such as a condominium, cooperative, cooperative unit, mortgage estate, or a home equity loan fund for a family member who loses their job and is unable to pay their mortgage • Own property that qualifies to be owned, rented, or purchased by a private family member with a disability, spouse or dependent child who has been separated from that family and/or who is receiving Social Security disability payments • Have other direct federal assistance, such as: Section 8 Housing vouchers, SNAP payments, Medicaid, TANK Assistance (TANK Plus (Temporary Assistance for Needy Families)), or another direct federal assistance from a state, the U.S. Department of Agriculture (USDA), a state agency, or US Department of Veterans Affairs (VA) for a family member who loses their job and is unable to pay their mortgage • Obtain a Federal Stafford loan from the SBA, and also to obtain federal student loans from the US Department of Education and/or the private loan service. You may apply for a Federal Stafford loan after you make a full payment to your mortgage(s) every month after your application is approved.

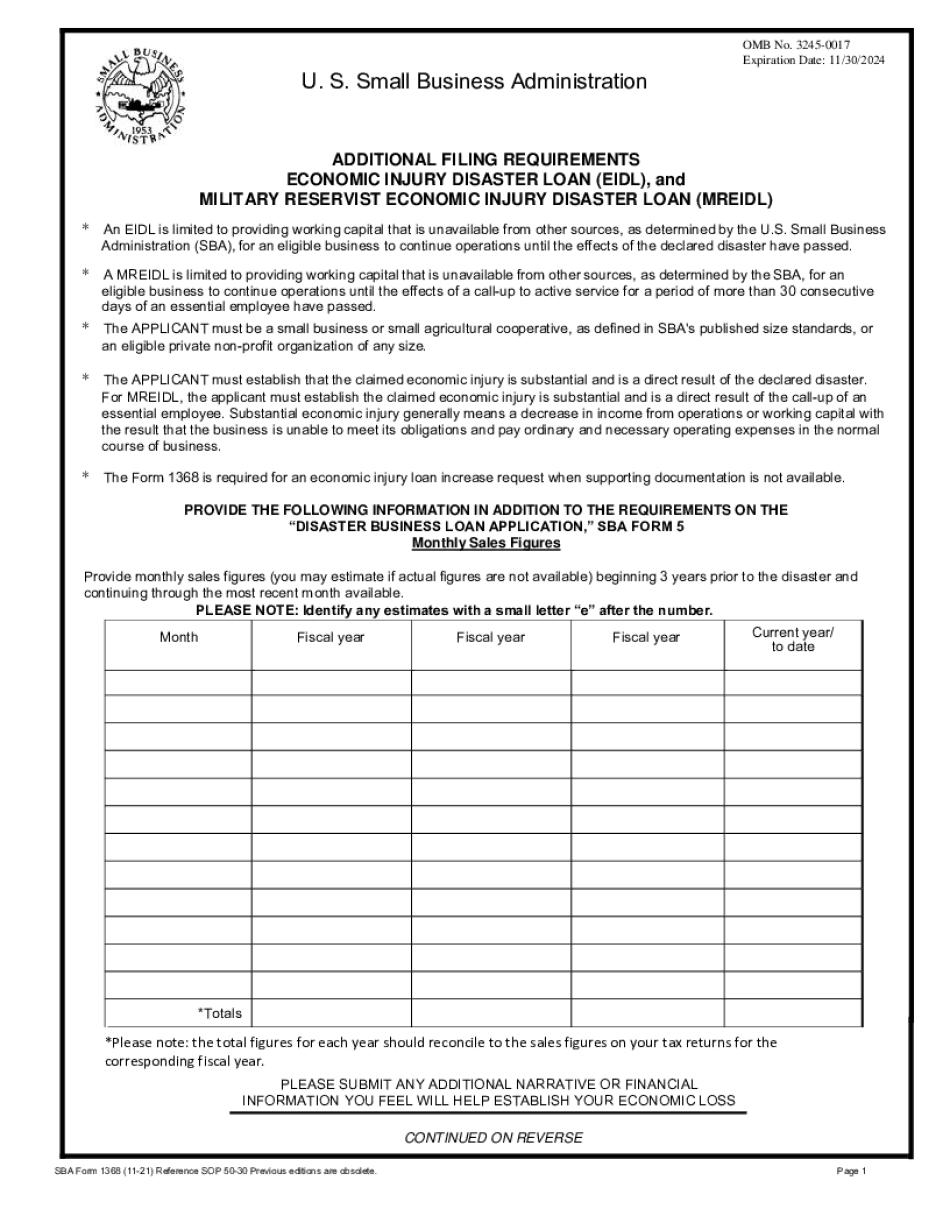

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Https disasterLoan Sba gov ela account register1