Welcome back Ms. Laura McGee. You must leave Strong Divorce Services. Next, we're going to work on filling out the FL 142, which is the schedule of assets and debts. So, here you are back on the forms page. Scroll down to the FO 142, and after you've looked at this video, go to the "fill on line" button. This is going to take you to PDF Filler, and you will put in your name and your email to get yourself started. This form is going to be delivered directly to me. What you should know about this form is that it operates like a table of contents. Okay, I'm gonna go it. There we go, let's go. Okay, so it'll brace like a table of contents. Take a look up here, top of the right-hand corner of the screen, and make sure that you realize that this form will only allow you to list all of your assets and your debts, all of the documents that support the values you came up with. You need to scan them to your spouse and copy me or bring three copies with you - one for you, one for your spouse, and one for me - when you come in for the mediation session and you're prepared to actually exchange your financial disclosures. So, like the other forms, we'll start up here. Put your name in here. And since you are self-represented, you put your name here. And you can put your phone number in here if you like. It's always ease of reference if I do have a phone number, but it's not required. As before, you are self-represented litigants, so you'll fill that in here. And we are not exchanging this court this form with the court. It's going to...

Award-winning PDF software

What is schedule of liabilities Form: What You Should Know

Including this form is voluntary and if you do not sign with certain information (for example, your date of birth and SSN) you are Required to fill in the “Other Information” area, and include your complete address. If you have multiple addresses, you are to include all of your addresses. You are encouraged to sign with your signature or if you do not have a signature, you can write in the space provided in the document. If you are not a United States citizen or resident alien, you are required to complete “other information: (for example, name of employee)” on the original document. Creditors who choose to file Form 2202 or use this method will be required to report any amounts under 250,000, as under Title 11 of the United States Code. You are not required to report the debt amounts in this manner. However, the form may be helpful in determining the amount of the debt obligation or income taxes due if you are dealing with a company or individual that is based outside the United States. 2. Information to be provided to the Clerk of Court: The name of the business and its parent company if it is a corporation. Also, describe the business in general terms. 3. Original balance due. If the original balance due is in the amount of 25,000 or less, you are not required to provide the original date of the contract. 4. Date of original instrument. If the date of the original instrument is unknown, you may have filed it early or made changes in the form. 5. All other information required by the clerk at the time the information is submitted. You may specify any items by which you wish to be notified at the time of receipt. 6. Copy of the application Form 5. 7. Signature: The signatures are required at the time of the filing of the Schedule of Liabilities. If the original balance due is between 25,000 and 250,000, or 250,000 or less, and there are 2 or 3 parties, or if 1 party has signed as owner or has been designated in writing, the original balance due document should not be filed, as only one party is involved. 8. All other information required by the clerk at the time of receipt and the application Form 5, for an order requiring the original balance due of an individual or business 8.

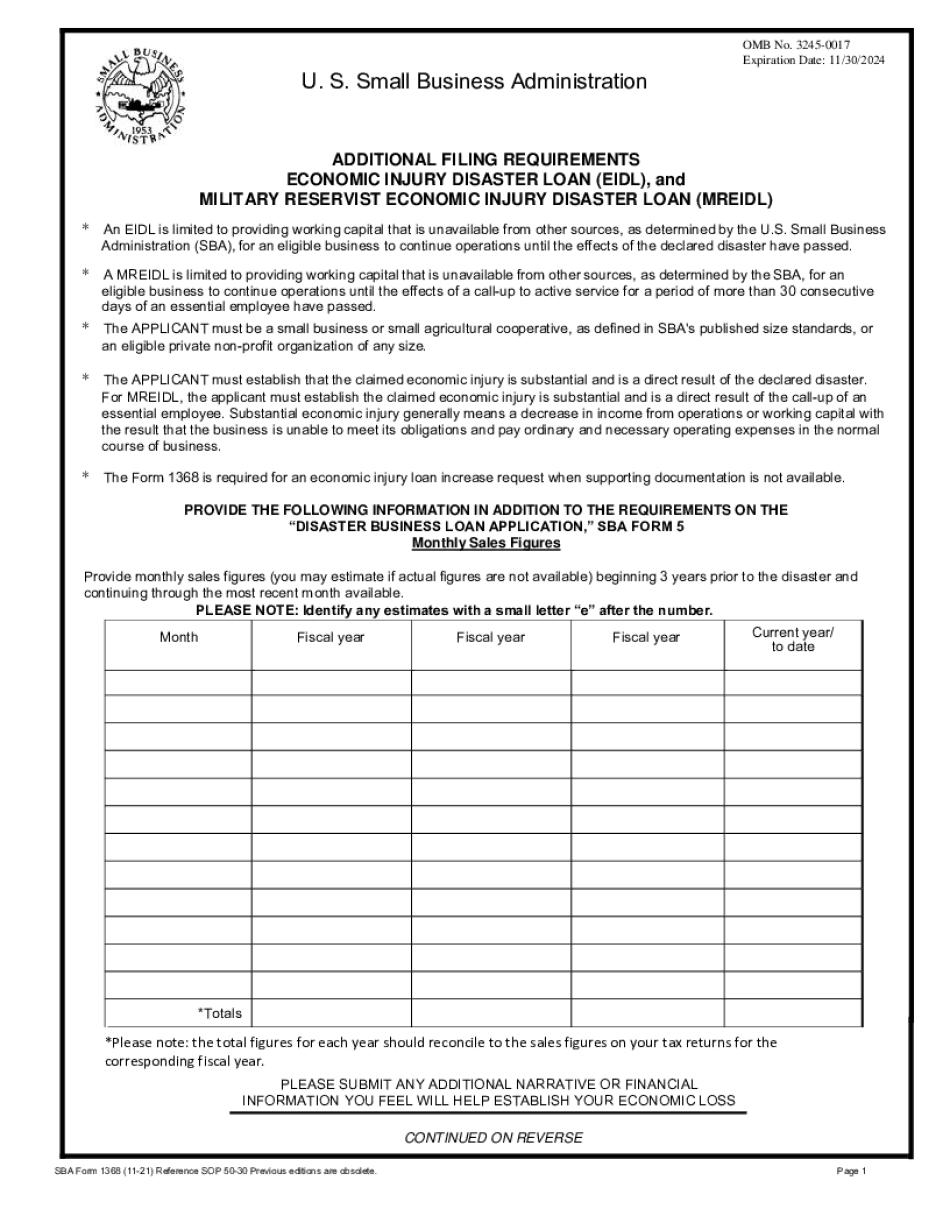

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is schedule of liabilities