Conditions are the items that outline the loan and tell you what we expect from you and what you can expect from us. Jeremy, what are some of the conditions we're looking at for this loan? One of the most important factors is who is liable for the loan. Is it you as individuals or does it involve a co-signer, maybe a parent or your wife? It could also involve an LLC of sorts. Another important condition is the verification of your assets and liabilities. This includes different cash accounts and retirement accounts that you provided on the balance sheet. We want to verify that the information you gave us is accurate. We need to make sure that if you say you have X amount of dollars, it is actually there. So verification may be a condition of the loan. Another condition is the position we hold in this loan. If it involves real estate, we must have a first lien position. This means that no one else can have a claim or a lien on the property other than us. It's important for us to be in the first lien position on this real estate transaction. For different types of loans, we need to ensure that the collateral you are offering us is sufficient for the needs of the loan and fits the term of the loan. Let's say you want to use cattle as collateral. We are happy to accept that, but if another lending institution has a lien on those cattle, we would have to pay that loan off so that we are the only ones with a lien on the cattle. Another point to consider is the term of the loan. Many individuals want the longest term possible, but we need to match the useful life...

Award-winning PDF software

Sba loan 5c Form: What You Should Know

U. S. Small Business Administration Disaster-Damaged ARE Real estate or business property damaged or destroyed by a major disaster if that property was damaged or destroyed due to the act of a terrorist in the act of waging or preparing an insurrection, or if the disaster does not include (a) damages to tangible property; (b) costs of cleaning up disaster-damaged property. U.S. Small Business Administration Disaster-Damaged ARE Disaster Loan Application — SBA The form is used by renters and homeowners to apply for assistance to repair or replace disaster-damaged SBA form. 5C. Disaster Home Loan Application — SBA The form is used by renters and homeowners to apply for assistance to repair or replace disaster-damaged SBA form. Jun 10, 2024 — SBA Form 5C, Disaster Home Loan Application is a document used by renters and homeowners to apply for SBA Disaster-Damaged ARE Form 5C Disaster Home Loan Application, which enables tenants and homeowners to apply for an emergency loan for repairs or replacement of their properties damaged, destroyed, or stolen from a disaster event. U.S. Small Business Administration Disasters and Disasters-Related Loans Real estate or business property damaged or destroyed by a major disaster if that property was damaged or destroyed due to the act of a terrorist in the act of waging or preparing an insurrection, or if the disaster does not include (a) damages to tangible property; (b) costs of cleaning up disaster-damaged property. Criminal Justice Business Loans Disaster Loan Application — SBA Required for commercial home loans, home equity loans up to 250,000, home equity line of credit (HELOT) up to 250,000, residential mortgage loans, and other similar purposes. Disaster Relief Assistance — SBA Home or business property damaged or destroyed by a major disaster. U.S.

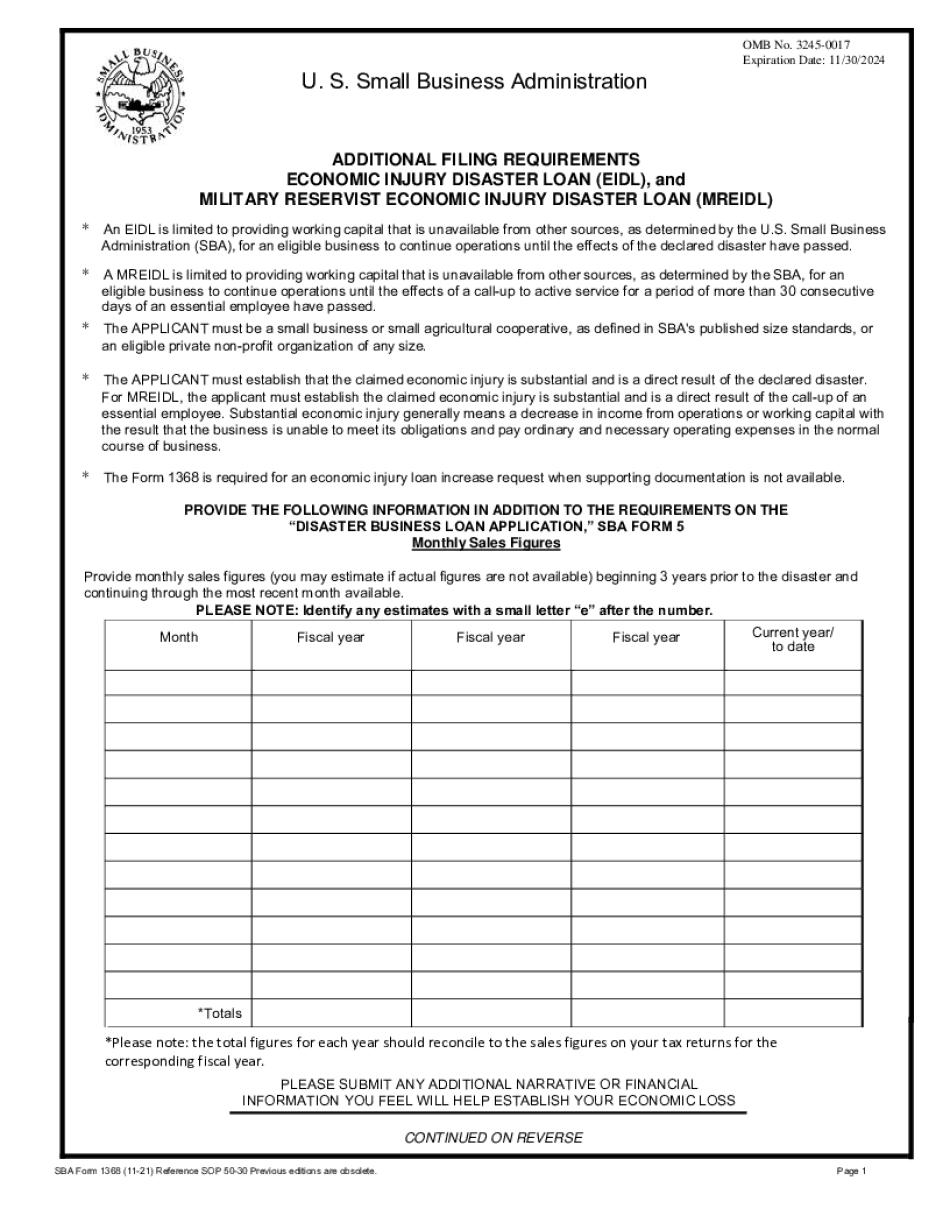

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba loan form 5c