Contrary to what many people think, the SBA does not loan money directly to small business owners. The loan actually comes from a bank and is backed by the SBA, allowing the bank to take a little more risk than they otherwise may do. Today's guest, Brandon Hinkle, CEO of pleura financial, a free online matchmaker between banks and small businesses seeking commercial loans, has tips for those applying for an SBA loan at a bank. One of the biggest misconceptions is that when you're getting an SBA loan, the check is coming from the government or the SBA. However, you're actually working with a bank. The bank relies on the guarantee from the SBA, but you still have to go through the bank's loan decision process. They will look at credit criteria and cash flow. The SBA loan is designed to help those who have a good amount of cash to repay the debt, but may lack collateral or years in business to justify the loan. When approaching the bank for an SBA loan, you would mention that you're looking for an SBA-backed loan. The SBA itself will direct you to an SBA lender, such as US bank or other banks that offer SBA loans. The bank will then recommend the most appropriate SBA loan for your needs, such as a 504 loan or a 7(a) loan. This means the SBA will literally tell you to go to a bank. It's important to note that there are various types of SBA loans available, not just one kind. It is advisable to do some research beforehand, but also rely on the expertise of the bank to guide you in the right direction. For example, 504 loans are meant for real estate and fixed assets, while working capital loans are typically 7(a) loans that...

Award-winning PDF software

Sba 413 Form: What You Should Know

SBA form 434 — Personal Business Financial Statement (SBG) Complete as follows: 1. The personal business financial statement must not exceed ten (10) pages in length (inclusive of the first page of the first personal financial statement) 2. All required information must be included on the first page of the second personal financial statement 3. The personal financial statement must be completed and signed by a person designated by either a proprietor or general partner 4. The personal financial statement (SBG) must include the following information for each proprietor, or a general partner: (1) gross monthly income, including gross operating income: gross income or gross income from businesses, and (2) net monthly income, including net operating income: net income or net income from businesses 5. Net operating income for all the proprietor's business operations must be reported on the personal business financial statement 6. Net operating expenses for all the proprietor's business operations must be reported on the personal business financial statement 7. Gross or net property or other income or expenses from a nonresident or foreign business activity must be reported on the personal business financial statement. SBA Form 434 is updated as follows: The person who serves as the responsible party shall change the name appearing in the personal business financial statement or business income statement on the Form 434 every three (3) years. If the responsible party fails to make the change after receipt of the request from the proprietor or the general partner or the stockholder of a general partnership, SBA shall provide a written notification, together with sufficient documentation, that the responsible party is failing to change the name appearing on the Form 434. 8a) Upon application for the SBA Disaster Loan Program, the proprietor or his general partner may designate a designated responsible party to fill out all the personal financial information for all business entities of the proprietor or general partner in accordance with SBA form 413. This Form 434 is revised: The proprietor or his general partner may request an amendment to an amended personal financial statement from the responsible party after the end of the three (3) year period to update information received from the proprietor or his general partner upon application for the SBA disaster loan program.

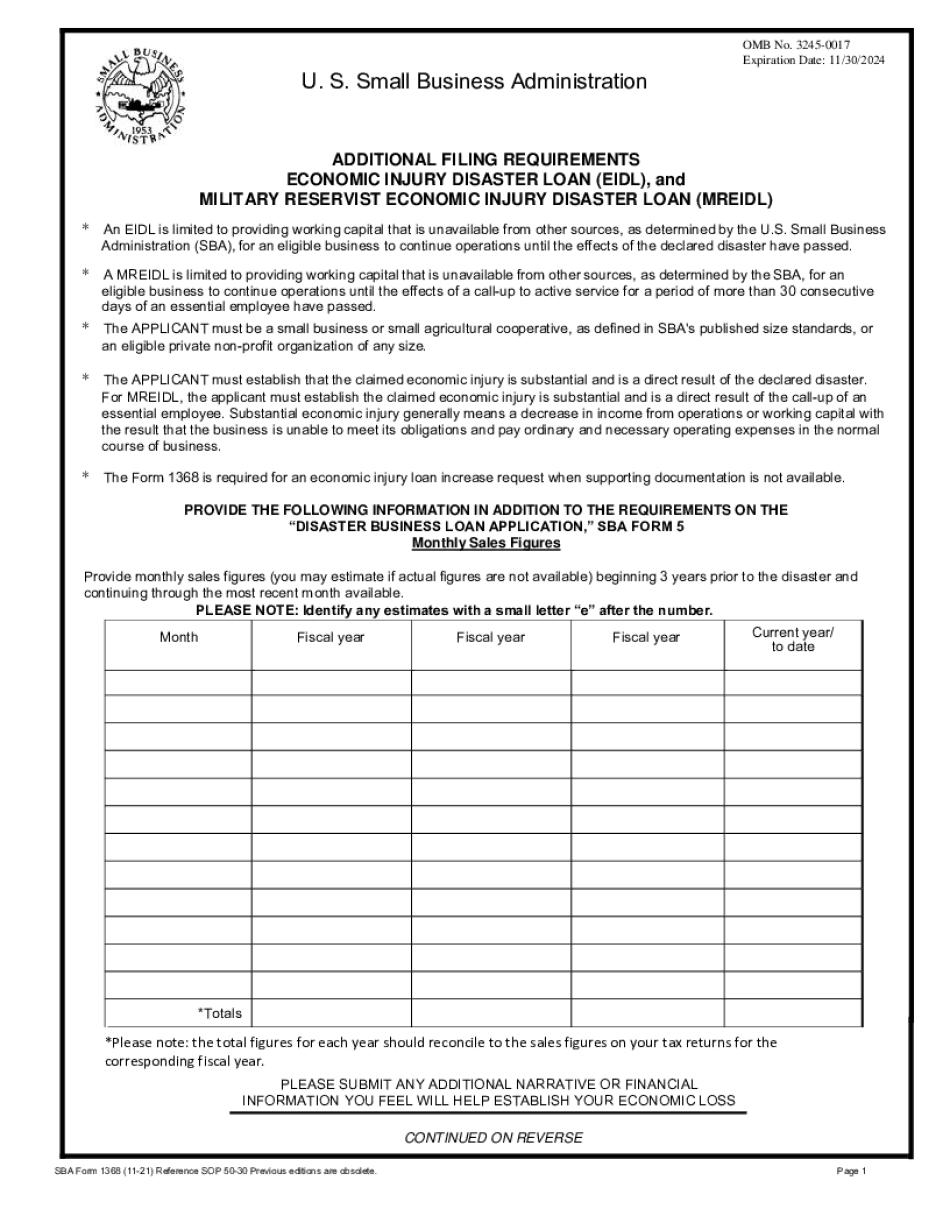

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba form 413