Welcome to the US Small Business Administration's guide for disaster assistance programs. This guide is designed to provide an overview of SBA's assistance programs, resources, tips, and regulations. For immediate assistance, please contact FEMA or SBA in your local community. You can reach FEMA by phone at 1-866-229-3239. In the aftermath of a disaster, such as a hurricane, flood, or tornado, SBA plays an important role. We assist businesses of all sizes, private nonprofit organizations, as well as homeowners and renters with recovery efforts. Our primary disaster assistance is in the form of direct loans. Disaster loans represent the only SBA program that is not limited to small businesses. This is an important point because many people do not realize that SBA provides disaster loans to individual homeowners and renters. In fact, the majority of SBA's disaster loans are made to individuals who are not small business owners. SBA and our network of professional business advisors also provide management and technical assistance to small businesses recovering from a disaster. Resources are available online, in nearby SBA or partner offices, community organizations, and recovery centers. This guide has four objectives: 1. Explain SBA's role in disaster recovery. 2. Define the types of disaster declarations and what they mean. 3. Describe SBA's disaster assistance loan programs and explain how to apply for assistance and access other resources. 4. Highlight additional economic tools towards the end of the guide. SBA has been assisting disaster survivors since 1953. Since that time, it has provided more than 1.9 million disaster loans, totaling over $53 billion. Again, it's important to point out that most of SBA's disaster loans are also made to individual homeowners and renters and businesses of all sizes, not restricted solely to small business owners. SBA's disaster loans are a critical source of economic stimulation in...

Award-winning PDF software

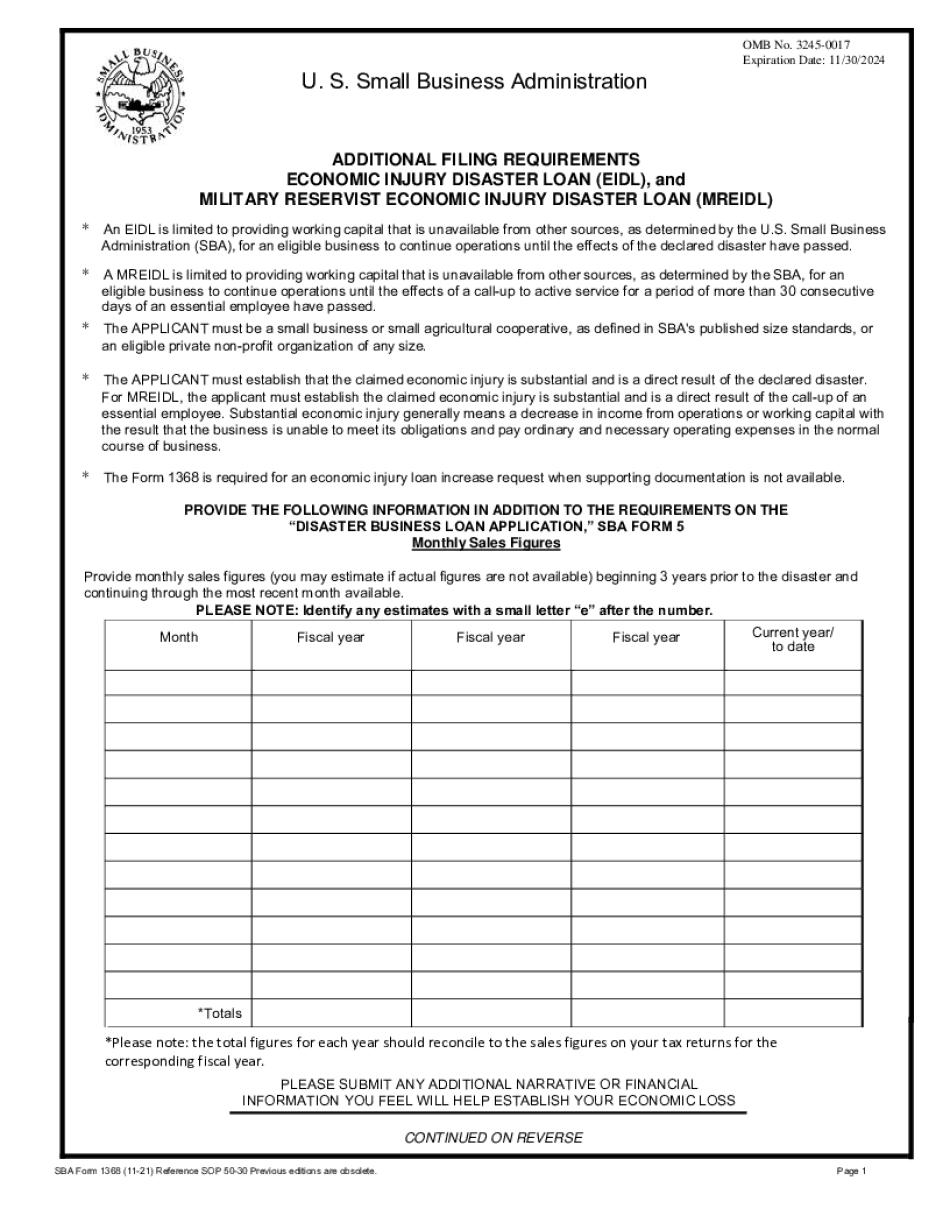

SBa 1368 Form: What You Should Know

Small Business Administration. Menu Notice of Final Decisions Dec 1, 2024 — The Small Business Administration has issued a notice of its final decisions on requests for emergency relief from mortgage debt and from foreclosure. The notice lists the date by year in which decisions were reached, how much each business will be able to recover from their borrowers, whether the borrowers will be required to pay the entire amount or only certain payments, whether any additional payments need to be made, and other information. A. Mortgage Recovery Payments — The Small Business Administration's Office of Inspector General has concluded its probe of mortgage loan servicing practices. In November 2017, the OIL found that borrowers who received loans were not fully informed of important information about the loans (for instance, that certain payments would affect which payments they would be required to make on the loan) or about the potential impact of the loan service's decisions. The OIL also concluded that some mortgage services failed to meet their statutory obligations under the Bankruptcy Code, including making reasonable efforts to comply with written and oral representations, and that there were significant weaknesses in the manner in which the services communicated with borrowers. B. Foreclosure Relief — The Small Business Administration (SBA) has concluded its investigation of foreclosure practices. In April 2017, the OIL concluded that foreclosures in 2024 were consistent with federal guidelines and were not at issue. In May 2017, the OIL concluded that loans originated in January 2024 were subject to mortgage servicing procedures that did not comply with applicable federal and state law. In February 2017, the OIL concluded that several large mortgages originated in the 1980s were nonperforming when it originated them, and were subsequently foreclosed. In November 2017, the Office of Inspector General (OIL) concluded that loan servicing problems with certain loans originated in 2024 still exist and continue to exist to this day. The Office of Inspector General concluded that loan servicing problems with loans originated prior to 2024 are still ongoing. The SBA notified borrowers that they may have a legitimate claim to receive a relief under the Small Business Administration disaster relief program if they meet the criteria in the small business disaster loan program. SBA Form 1368 is used to request a relief from mortgage debt of 50,000 or less.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sba Form 1368, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sba Form 1368 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sba Form 1368 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sba Form 1368 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sba Form 1368